The recent auction results seem to have raised concerns around dealers and collectors alike, showing a downward trend of trading prices for the first time in about thirty years.

At the same time, sales appear to be slower than what we had gotten used to and the demand for the models that represented the everyday bread and butter of the market has definitely lost a little steam. It’s worth mentioning right off the bat that this phenomenon affects mainly watches that are relatively common stock. The culture of watchmaking has grown to a point where we now know what our Michelangelos, Da Vincis and Picassos are: I wouldn’t expect to ever find those watches pass unnoticed in a minor auction and sell for nothing.

I have received a few calls in the past weeks from other watch guys – both professional and non – interested in knowing what I thought about this. One asked, more specifically, “we all know the market for new and contemporary watches has taken a dive and that makes sense, but now vintage too?” Well, I am surely not an economist and probably not even the best informed in all things money, but have been around this block for a while and have witnessed firsthand the birth, the first demise, the steady growth and finally the explosion of our market, so I am confident I can offer an educated opinion those of you who may have similar questions.

First of all, a little history.

The vintage watch market started building momentum in the early eighties, showing a slow but consistent growth in demand for vintage and pre-owned timepieces and kept growing steadily for a decade, give or take. Until then, watches were generally regarded as consumers’ goods, and the idea that after having been used and surpassed by new designs, models and technology a watch wouldn’t hold any particular economic value – in spite of it possibly initial high price – was broadly accepted. Not that different from luxury automobiles, if you think of it: the average driver of a top-of-the-line Range Rover, Bentley, Mercedes or what have you, will gladly spend a couple of hundred grand on his dream car, lose half of his money over a three-year period, factor that in and merrily walk into a dealership to repeat the experience all over again. But in today’s world, tell that same guy that his watch hasn’t made him any profit or, worse yet, lost some of its initial value, and he’ll lose his fucking mind.

But how did we get here? You will find this story familiar. Across the eighties the market belonged to little more than a handful of dealers who found themselves in the right place at the right time: the demand for high-end watches growing fast, with an apparently endless supply from original owners – or their heirs – who had no clue that the watches they were getting rid of were passing hands for multiple folds their selling price, again and again.

The most successful of these dealers coalesced in a sort of cast that showed very little interest in opening up to younger generations or even just learn much more than the little they already did about watches and had so far sufficed to make them very wealthy.

To be fair, this doesn’t apply to all of them, but a good majority for sure. Their appearance of prestige and wealth also conferred them an aura of authority and credibility that made for us rookies very hard to make a name for ourselves. In the meantime, with the last rush of increasing prices, everybody had turned into a watch dealer: the barista at the coffee shop had a deal on two-tone subs, the optician around the corner was the go-to guy if you had a Daytona to sell.

Around 1990, however, things changed rapidly.

The market’s fast rise of the preceding last few years that had brought a steel vintage submariner from $ 1,000 to $ 5,000 and a Patek Philippe 1518 from $ 15,000 to $ 150,000 (today a good example brings $ 1M), started giving signs of collapse, reminiscent of the bursting of a speculative bubble. To my surprise, some of the dealers I was looking up to started offering some of their most coveted timepieces for two thirds of their lower estimate just a few weeks ahead, willing to take a loss on a single watch greater than my then meek entire working capital. I couldn’t fathom why: I was in the in the game to maybe make the dream of owning myself one of those watches come true some day and these guys, who could effortlessly afford to keep them, were getting rid of them! I was turning pro just when the pros were getting the hell out as fast as they possibly could. The market was flooded with watches that just a few weeks before were so much more expensive, their prices going up by the week.

The years that followed were, contrarily to my darkest fears – I had left my secure job to become a watch dealer! – the best I can remember. The market’s reset created opportunities of all kinds. I remember starting off with buying a steel Vacheron & Constantin chronograph from the late forties for about $ 6,000 as opposed to the $ 18,000 the same dealer had charged a few months before. I didn’t make much money on it, but having access to next level watches meant not only the coming true of my wildest dreams, but also access to next level clients.

From 1990 to 2010 prices kept growing again slowly, but reasonably and steadily, and so did a whole new generation of dealers and collectors. Around the end of that run, however, the world started witnessing what I believe must be the biggest boom the watch industry has ever seen.

Mainly thanks to the market that we had created, if you ask me: the big manufacturers saw their industry have a new spring after we had managed to revolutionize the culture of watches, transforming them from a decadent manifestation of wealth, luxury and prestige into an unprecedented, educated appreciation of the art of watchmaking and watch design. Along with that, however, also came the illusion that any high-end watch would turn into a commodity that would never fail to financially reward every “investor” as opposed to “end user”. A trading game, where the smartest of us couldn’t fail to succeed: and in an upswing trajectory market, everybody is a genius.

Sadly, “this watch will be worth a lot more money before you know it” became the most popular selling pitch you’ll hear from a dealer. Nothing delivers the desired reaction from people better than telling them what they want to hear and, soon enough, our world of vintage watches started becoming crowded with people who were in for the gain rather than the experience. And the bigger the game, the bigger the money, as prices were driven up, especially at the price range where the majority of buyers could afford to play. These are the people who realize they are not really into watches, after all, when the passion starts coming with a cost rather than a profit.

It’s just history that repeats itself: to quote William Faulkner, “The past is never dead. It’s not even past.”

I come from a place where vintage watch buyers – be them one timers or true collectors – used to buy their watch because they wanted to own it, enjoy the – unthinkable to so many – privilege of living an experience that was important to them, in the first place: and if that came with a gain, better yet. Today, things apparently work the exact opposite way. I know this is going to make me sound like an old fart, but I feel as though our world has been hijacked at some point, and we have been taken places we didn’t necessarily want to go.

Look, I don’t necessarily want to demonize speculators. Every market in rapid ascent will attract investors wanting to get on board to take advantage of the momentum. I am not expressing any judgment of ethical or moral nature: the money game intersects with all kinds of worlds and that’s that. It should not in the case of health care, education and politics if you ask me, but at the end of the day that’s just the way it is. And I am not even saying that these people are intentionally acting in ways that are detrimental to our market and community: in fact, I could tell you any number of stories where prominent members of this community have deliberately acted in ways that hurt literally everybody in the name of personal profit, to boost their own ego, or both. I am just pointing out their role in driving up the market sometimes to levels that don’t make any sense, like brand new watches retailing $ 50,000 traded at $ 200,000 on the open market, or classic pieces raked on the market in multiple examples to create offer scarcity and then resold when prices were much higher: we have to thank those guys for that. But it’s also true that the phenomenon brought some collateral benefits to the market as well, such as drawing the attention of global public and media, causing the passion we share and the culture of vintage watches to spread across all borders. And I will also add that this market was in fact financially underrated – in part I believe it still is, but this is a different conversation – and the speculation game has in some cases help align some prices to actual value. In fact, do not confuse the ordinary production watches selling for stellar prices with the important vintage pieces that are now selling for millions. These are two different markets: the first one is pushed up by speculation, the latter one is only making its way to a space of public recognition. Nobody is cornering the market of double crown world time Pateks.

When, however, for whatever reason – in this case geopolitical instability, uncertain economies and, especially, a market exploited beyond its intrinsic value (at least for now) – the market’s growth shows a tendency to fade, many buyers who joined for fun and curiosity realize they were not really in for the unique, extraordinary experience of being part of this culture as much as for the illusion only, or flat-out the monetary gain. Failing to meet these expectations they start selling, or stop buying at best. Which, in a market that’s catching its breath, is the perfect recipe for a deflation. And here we are, as expected.

Today’s world is certainly not that of thirty-five years ago, but we can all imagine what the consequences of an excessive offer to a diminished demand are likely to be.

It’s worth noting, however, that the last gold rush has not attracted only short-term speculators and imprudent investors, but also an incredible number of new – often younger – passionate aspiring collectors and dealers: and with them, a more deeply rooted culture of watches in general and vintage in particular, a more sophisticated knowledge of the art and industry’s intimate details with a new perspective for the appreciation of brands, models and styles.

Am I worried of what’s coming? Well, I certainly should be: like many of us whose livelihood depends on the vintage watch market, I worked my dream job for decades, owned some of the most extraordinary timepieces ever made and experienced a lifestyle like few others but, truth be told, I can’t really say I have put away any money: unlike many of my clients who are evidently smarter than me, all I saved over a lifetime in the game is a decent number of good watches, maybe a few very good ones.

This means that in a market’s crisis all I worked for my whole life could almost instantly lose 20, 30, maybe even 50%. But I know from experience that it’s only a matter of time before some of these watches, maybe all, maybe a few, will regain all they may have lost and then some. Which ones? As much as I like to think I should be able to tell, only the new trends and perspectives brought in by the latest and future generations of watch aficionados will set the parameters to make that determination. This is the time when the rats leave the ship fearing it’s about to sink, and the air will finally become more breathable: the tighter market conditions will make things a little harder, to the point that those who have not come to the hobby with a passionate heart will go looking for easier opportunities elsewhere.

Am I even disappointed? Do I wish I had sold that or the other particular watch when the market was more favorable? Maybe a little but, just to be clear, only because the liquidity would give me ammunition to keep buying the pieces I am drawn to, again and again, moving forward. This being said, I have never taken for granted that prices would only go up and I have always been ok with that. As I state – in a slightly provocatory title of this article – I somewhat welcome the moment. If what we fear is what’s actually going to happen, well, it’s not going be the end of anything good but the beginning of something better. I will quote my own website: “I never shopped for price and always strived to buy only the extraordinary. It’s a philosophy that has always paid back myself and my clients and, as far as I am concerned, the founding principle at the base of any collection that is meant to be a wise investment.”

I buy what I love and find extraordinary – if I can afford it – and regardless of its price, I will always be happy with it.

That is, in my vision, the wisest investment in watches, an experience we can gift ourself with to make the best of the only one life we have been gifted with. If that watch is worth more or less than what we paid will not make any difference for any of us soon enough, unfortunately. But if we feel joy looking at it, showing it to our friends or wearing it, it will be the wisest investment we have ever made. With my sincere condolences for those who miss out of this opportunity, seeing in the – sometimes fantastic – watches they have bought only the price instead of the value, fuming in rage if that’s gone down, instead of appreciating the privilege life has given them. But these considerations I will keep for a future story, if you will want to hear it.

The Base of All My Decisions

For a change, I will not write about watch restoration and the ways in which this affects, mainly in the wrong way, both the value and the market of a vintage watch. I would like, instead, to debate the assessment process through which we could – or should, in my opinion – be able to rate such value on a percentage basis or a zero to ten scale. This is obviously my own personal method that is surely susceptible of improvement, but that is the base of all my decisions regarding the buying or selling of a vintage watch.

AN ARRAY OF ANALOGIES

BETWEEN THE COLLECTIBLE WATCH MARKET AND THAT OF VINTAGE AUTOMOBILE OR ANTIQUE PAINTINGS

You have certainly heard, especially with regards to watch restoration, an array of analogies between the collectible watch market and that of vintage automobiles or antique paintings, to mention the most common ones. There are, however, many other similar cases: from postage stamps to writing instruments, from antique silver to coins. In my opinion these are arguably categories that present some similarities to that of vintage watches, but are nonetheless quite different: in fact, all these different objects can be just as desirable, but for a different reason or, better said, a different combination of reasons. And, moreover, each of these categories reflect values determined by a combination of prerogatives that are unique to that very category: for a painting, its appearance is for sure more important than its state of preservation, for a post stamp it’s true the exact opposite; for an automobile functionality is a key factor, but for a silver samovar or a lantern, a detail of little importance.

Just as for any other category of rare and collectible objects, the evaluation criteria of a vintage timepiece include several elements, many of which in common with those of other categories, but still unique to that of vintage watches only: conversely, some other parameters, although applicable to different other objects, cannot be used to assess a vintage watch without doing some damage just like, at least in my opinion, it is actually happening. The elements that for me determine the value – both financial and “cultural-emotional” – of a vintage watch can be divided into two main categories: those of aesthetical nature and of technical-historical nature. My rating will be as much higher as the values within each of these categories are equally balanced, like the two plates of a scale bearing the exact same weight. The more aligned all the evaluation parameters, the more visible will be what I like to define as the “magic” of a given watch.

My rating will be as much higher as the values within each of these categories are equally balanced, like the two plates of a scale bearing the exact same weight.

Within the realm of the aesthetic perspective are, above all, the overall beauty and the visual impact of the watch: these are two elements that can actually prescind even from its preservation state or the absolute originality of its every component; the patina, or the whole visual effect given by the presence – or lack of – signs of aging; the preservation state, from the example untouched but totally destroyed, to the one that has been restored to perfection, from the one absolutely untouched and still like new, to others showing every shade in between; the combination model-color, like for example, a watch that has a particularly rare dial color and/or hands style, or in a particularly unusual metal for that model, like a steel and gold Patek Philippe chronograph.

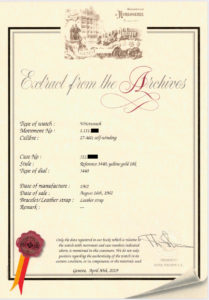

On the other hand, belong to the technical-historical sphere all the elements that relate to the exact prerogatives of a given watch the day it left the factory. First of all, the originality of each component, that have to necessarily be – at least as far as there is any even minuscule visible difference – factory original; the consistency of each component, meaning that if not “born” with that very watch they be at least the exact same that was included in the original manufacturer’s design and plans; the period correct element, meaning that all components not only need being factory original, but also correct for the watch’s production timeframe; the rarity of the timepiece as it relates to production numbers; its desirability and availability from a demand/offer perspective; the presence of any original paperwork and accessories.

“PERFECT”

IS NOT ALWAYS PERFECT

Theoretically, on a percentage scale a watch in absolutely “like new” conditions should always be the benchmark for a 100% rating, but in my opinion that is not necessarily always the case. In fact, it is well possible that a watch that shows some aging or some wear may still score the highest possible rating when some of the elements other than condition make up for the flaws. By the same token, it is possible that a well restored example may be more valuable than another that was never “touched” but aged badly, or that an example with very visible marks of aging – a perfect example would be that of the “tropical” dials – may be more desirable than the same exact model in absolutely perfect conditions. The “perfect” watch is not always, necessarily, perfect.

The generalized need to unify all the evaluation criteria in one one-size-fits-all code easily applicable by collectors and professionals alike worldwide has reduced this complex process to something similar, to use an example that I find particularly fitting, to that of antique postage stamps: if these are absolutely unused, perfectly “centered”, with a mint gum as originally sold by the post office, their value is 100/100. But the moment one only of these parameters is off, their value falls dramatically to a fraction of the full rating. When this same method is applied to vintage watches – that very, very rarely arrive to us in truly unworn conditions – the consequence is that these “ideal” conditions are often the result of invisible restorations or small improvements, such as the replacement of the damage components with same original parts, but in better conditions: agreeably accepted by dealers, but not shared with their buyers, this seems to be the only way to keep sustainable a market otherwise too resourceless to satisfy the often unrealistic expectations of the demand.

TRUE EXPERIENCE SHALL NEVER HIDE

VERSUS OPPORTUNIST “EXPERTS”

This situation has also contributed to the growth, between dealers and collectors, of the category – non-existent until just a few years ago – of vintage watch experts and consultants, a new profession that allows to profit from this market without paying the dues, finding or investing significant funds, exposing oneself to costly errors, scams, thefts or robberies. The experience matured by the “OGs” during the first decades of this experience is today available online for free: all one needs, is the time to study the available material – or at least enough of it to know a bit more than the next guy does – online, combined with some self-promotion skills, to be an “expert” who can charge for his services more than he could make buying and selling the same watches for which the consulting is offered. And, more often than not, without having ever owned one, or even a similar one, himself. Obviously, I do not have a high opinion of the category, but do acknowledge that whereas it does include a decent number of totally incompetent opportunists and a handful of unhinged haters, it also counts a few extremely educated individuals who, in my opinion, could help with their same work the future of this market rather than its demise. This is something that I promise to get into detail sometimes in the near future.

MONEY OR PRIDE

DEFINING AN OBJECT WITH CULTURAL ATTRIBUTES

These are, for the most part, more or less informed archivists who excel in comparing all the data available online and/or the equivalent of laboratory technicians, perfectly able to spot an unknown or undisclosed restoration, but apparently unprepared to understand its value or to contextualize it into a true complete evaluation of the example at hand; to attribute monetary values relying on statistical data based on auction results, but unable to suggest any other value than previously attributed to a similar watch by a market precedent; and, especially and unfortunately, perfectly able to leverage on their clients’ fear of losing and desire for gain – both in terms of money or pride – to consolidate a method that grants their industry growing prosperity at the expense of the emotional, esoteric, stylistic and exquisitely aesthetical elements that have determined the very birth of this passion and market as we have learned to love it since its beginnings in the early 1980s. Deprived of its emotional content, that in so many ways make the way we perceive a vintage watch similar to that of a work of art, its unique prerogative to become part of its owner’s personality so similar – at least for most men – to that of some automobiles or motorcycles defining an object with cultural attributes absolutely unique to its own category, the incredibly rich world of vintage watches is on the brinks of following the fate of that of postage stamps and collectible coins.

Today I will not write about watch restoration and the ways in which this affects – mainly in the wrong way – both the value and the market of a vintage watch. I would like, instead, to debate the assessment process through which we could – or should, in my opinion – be able to rate such value on a percentage basis or a zero to ten scale. This is obviously my own personal method that is surely susceptible of improvement, but that is the base of all my decisions regarding the buying or selling of a vintage watch.

You have certainly heard (regarding watch restoration), an array of analogies between the collectible watch market and that of vintage automobiles or old paintings, to mention the most common ones. There are, however, many other similar cases: from postage stamps to writing instruments, from antique silver to coins. These are arguably categories that present some similarities to that of vintage watches, but are nonetheless quite different: in fact, all these different objects can be just as desirable yet for a different reason or, better said, a different combination of reasons. And, moreover, each of these categories reflect values determined by prerogatives that are unique to that very category: for a painting, its appearance is for sure more important than its state of preservation, for a post stamp it’s true the exact opposite; for an automobile functionality is key factor, but for a silver samovar or a lantern a detail of little importance.

Just as for any other category of rare and collectible objects, the evaluation criteria of a vintage timepiece include several elements, many of which in common with those of other categories but still unique to that of vintage watches only: conversely, some parameters – albeit also applicable to different objects – cannot be used to assess a vintage watch without doing some damage just like it is actually happening… at least in my opinion.

The elements that for me determine the value – both financial and “cultural-emotional” – of a vintage watch can be divided in two main categories: those of aesthetical nature and of technical-historical nature. My rating will be as much higher as the values within each of these categories are equally balanced, like the two plates of a scale bearing the exact same weight.

The more aligned all the evaluation parameters, the more visible will be what I like to define as the “magic” of a given watch.

Within the realm of the aesthetic perspective are, above all, the overall beauty and the visual impact of the watch: these are two elements that can actually prescind even from its preservation state or the absolute originality of its every component; the patina or the whole visual effect given by the presence – or lack of – signs of aging; the preservation state, from the example untouched but totally destroyed, to the one that has been restored to perfection, from the one absolutely untouched and still like new to others showing every shade in between; the combination model-color, like for example a watch that has a particularly rare dial color and/or hands style or in a particularly unusual metal for that model, like a steel and gold Patek Philippe chronograph.

TECHNICAL DETAILS FOR COLLECTORS

THE MAGIC IS MADE OUT OF TINY ELEMENTS

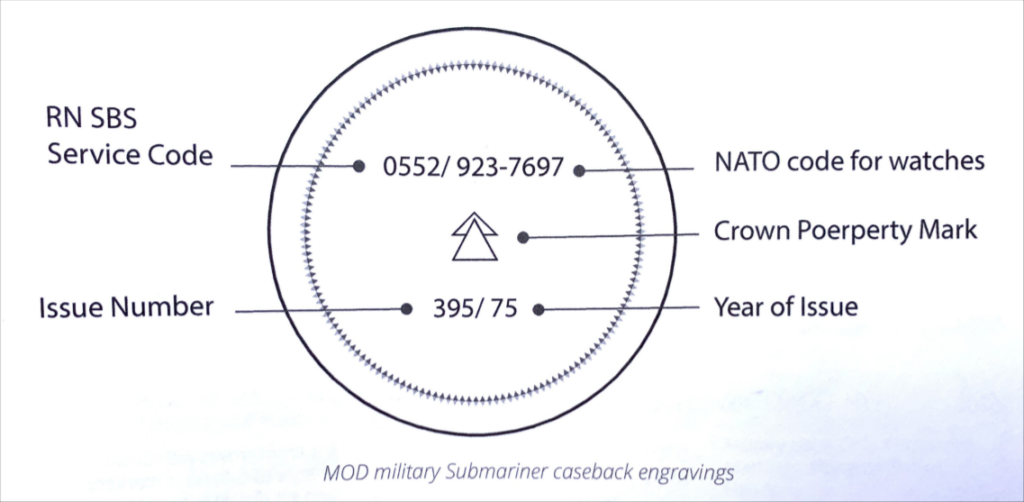

On the other hand, belong to the technical-historical sphere all the elements that relate to the exact prerogatives of a given watch the day it left its original manufacturer. First of all, the originality of each component, that have to necessarily be – at least as far as there is any even minuscule visible difference – factory original; the consistency of each component, meaning that if not “born” with that very watch they must be at least the exact same items included in the original manufacturer’s design and plans; the period correct element, meaning that all components are not only factory original but also correct for the watch’s production timeframe; the rarity of the timepiece as it relates to production numbers; its desirability and availability from a demand/offer perspective; the presence of any original paperwork and accessories.

DOES THE “PERFECT WATCH” EXIST ?

EVERYTHING IS PERSONAL

Theoretically, on a percentage scale a watch in absolutely “like new” conditions should always be the benchmark for a 100% rating, but that is not necessarily always the case. In fact, it is well possible that a watch that shows some aging or some wear may still score the highest possible rating when some of the elements other than condition make up for the flaws. By the same token, it is possible that a well restored example may be more valuable than another that was never “touched” but aged badly, or that a specimen with very visible marks of aging – a perfect example would be that of the “tropical” dials – may be more desirable than the same exact model in absolutely perfect conditions. The “perfect” watch is not always, necessarily, perfect.

DOES IT MAKE ANY SENSE TO STANDARDIZE?

WATCHES AREN’T LIKE POSTAGE STAMPS

The generalized need to unify all the evaluation criteria in a one-size-fits-all code easily applicable by collectors and professionals alike worldwide has reduced this complex process to something similar – to use an example that I find particularly fitting – to that of antique postage stamps: if these are absolutely unused, perfectly “centered”, with a mint gum as originally sold by the post office their value is 100/100. But the moment only one of these parameters is off, their value falls dramatically to a fraction of the full value. When this same method is applied to vintage watches – that very rarely arrive to us as truly unworn – the consequence is that these “ideal” conditions are often the result of invisible restorations or small improvements, such as the replacement of the damage components with same original parts but in better conditions: agreeably accepted by dealers but not shared with their buyers, this seems to be the only way to keep sustainable a market otherwise too resourceless to satisfy the often unrealistic expectations of the demand.

THE ONLINE FLATTENED THE VALUE OF EXPERIENCE

WEB SEARCHING ISN’T LIKE TOUCHING AND WATCHING A PIÉCE

This situation has also contributed to the growth of the category – non-existent until just a few years ago – of vintage watch experts and consultants, a new profession that allows to profit from this market without paying the dues, finding or investing significant funds, exposing oneself to costly errors, scams, thefts or robberies. The experience matured by the “OGs” during the first decades of this market is today available online for free: all one needs is the time to study the material available (or at least enough of it to know a bit more than the next guy does) combined with some self-promotion skills, to be an “expert” who can charge for his services more than he could make buying and selling the same watch for which the consulting is offered. And, more often than not, without having ever owned one, or even a similar one himself!

Obviously, I do not have a high opinion of the category, but I do acknowledge that whereas it includes a decent number of totally incompetent opportunists it also counts a few extremely educated individuals who, in my opinion, could help with their same work the future of this market rather than its demise.

This is something that I promise to get into detail sometimes in the near future.

These newcomers are for the most part more or less informed archivists who excel in comparing all the data available online and/or the equivalent of laboratory technicians, perfectly able to spot an unknown or undisclosed restoration but apparently unprepared to understand its value or to contextualize it into a true, complete evaluation of the example at hand; to attribute monetary values relying on statistical data based on auction results, but unable to suggest any other value than previously attributed to a similar watch by a market precedent; and, especially and unfortunately, perfectly able to leverage on their clients’ fear of losing and desire for gain – both in terms of money and pride – to consolidate a method that grants their industry growing prosperity at the expense of the emotional, esoteric, stylistic and exquisitely aesthetical elements that have determined the very birth of this passion and market as we have learned to love it since its beginnings in the early 1980s.

THE DETRIMENT OF THE EMOTIONAL PART

TO APPRECIATE A VINTAGE OBJECT WE MUST FREE SPACE TO PERSONAL TASTE

Deprived of its emotional content, that in so many ways makes a vintage watch similar to that of a work of art, its prerogative to become part of its owner’s personality defining an object with cultural attributes absolutely unique – so similar, at least for most men to that of some automobiles or motorcycles – the incredibly rich world of vintage watches is on the brinks of following the fate of that of postage stamps and collectible coins. Alessandro Ciani / L.A. (Usa) / Feb.2022.

Looking at the Jeep on my site, I could not fathom not understanding the beauty of its history. The appreciation for its history.

Back in November of 1940, the Jeep legend began. This would be the very early days of the second World War, one year before the United States entered. A small, four-wheel power prototype, the Willys “Quad”, turned into delivered to the US Army.

It featured the Willys “Go-Devil” engine, developed by way of Delmar “Barney” Roos. With 60 horsepower and one zero five foot-pounds of torque it not simplest surpassed the Army’s requirement, but dwarfed the Bantam’s 83 and Ford’s eighty five pound-feet of torque, it’s only competition for the army contract.

The Quad became the father of the MB, CJ series, and Wrangler. Willys refined the Quad and built 1,500 gadgets of the Willys MA model, lots of which had been used in WWII.

From 1941 to 1945 Willys produced the MB model, the unique go-anywhere, do-anything vehicle, which came to be known by means of its nickname, “Jeep”.

Made famous during WWII, Willys produced over 300,000 MB vehicles. Jeeps were closely used by way of every division of the American navy, with a hundred and forty four Jeeps provided to every infantry regiment inside the U.S. Army.

Large numbers of Jeeps were shipped to the Allied Forces of Britain and Russia: nearly 30% of general Jeep production.

The MB advanced into the M-38 military model, which featured a water-proof ignition device and was constructed from 1950 to 1951 in particular for use in the course of the Korean War.

During that conflict, Willy redesigned the M-38 and it became the M-38A1 with a longer wheelbase, softer ride, a extra powerful engine and a new, extra rounded body style.

In production via 1962, at some stage in that time Willys additionally produced the M-170, which turned into designed to be geared up with numerous different frame packages. One was a light troop carrier.

Because passengers were incredibly enclosed as compared to earlier models, the M-170 changed into extensively utilized as a area ambulance. Kaiser Willys Auto Supply has antique Jeep elements for all Willys military Jeep models.

To find out more and look at the details of my own Jeep Willys, please visit Garage Queens.

Did you know? The first ¼ ton, four-wheel power reconnaissance truck “pilot model” produced for the U.S. Army became built through the American Bantam Car Company of Butler, Pa.

It become added for testing to Camp Holabird in Baltimore on Sept. 23, 1940. Subsequent designs by way of Willys-Overland and Ford while vital were refinements on this authentic U.S. Army and American Bantam concept.

It become added for testing to Camp Holabird in Baltimore on Sept. 23, 1940. Subsequent designs by way of Willys-Overland and Ford while vital were refinements on this authentic U.S. Army and American Bantam concept.

One of the maximum distinctive factors of the “jeep” layout is the flat slotted grill with incorporated headlights – for this – Ford gets the credit.

Ford’s Pilot Model GP- No. 1 “Pygmy” featured a flat grille with incorporated headlights introduced to the U.S. Army on Nov. 23, 1940.

From thirteen slots (1940), to 9 slots (1941), to seven slots (1945) – it truly is the history of the iconic “jeep” grille. The main motive Willys-Overland received the lion share of the production for the WWII “jeep” become its engine. Willys-Overland fortunately started reworking its L134 engine in 1938 with the appearance of Barney Roos as chief engineer. The result became the long lasting and powerful “Go-Devil” engine that became the coronary heart of the “jeep” for decades.

Willys-Overland produced as a minimum Pilot Model “Quads” in 1940.

After 1952 the road up of military “jeep” models included a Willys-Overland Pilot Model Quad (a ways left).

For more information on my own Jeep Willys, please send me a message!

If you are looking at purchasing a brand new luxury watch, then I would probably recommend (with an unbiased opinion of course) to look at luxury vintage watches.

Before we go into why, let’s look at what happened in Switzerland this past month.

Among the world’s great watchmakers, Rolex became the first to announce it would briefly shut down as the worldwide COVID-19 pandemic worsens. Now, the rest of the (non-vintage) watch world is speedy following suit.

Less than a day after Rolex announced that it would be closing its production on Tuesday, Hublot ended up doing the same. A few days later, Patek Philippe, Audemars Piguet and MB&F had delivered themselves to the list of manufactures that were following suit. In Patek Philippe’s case, each its main office and production facilities would be closed until March 27, same as WWD.

Audemars Piguet made its announcement on Twitter, where it stated the enterprise would close a portion of its workplaces, production websites and shops. “In this period of uncertainty, people’s safety stays at the coronary heart of our priorities. This is why we have determined to shut our Swiss production sites as well as some of our offices and boutiques in various countries till the stop of March,” its Tweet read.

Beyond a feel of corporate responsibility, the closures had been precipitated by way of Switzerland’s state of emergency, which limits crowds and has pressured maximum non-essential companies to cease regular operations. That declaration calls for all shops, restaurants, bars, leisure and entertainment facilities to shut till similarly notice.

With a number of the field’s maximum vital players down for the count, chances are high that the ones still status will soon adjust path and shutter the parts of their very own operations they can.

Those owned with the aid of conglomerate LVMH––Hublot, Tag Heuer, Zenith, Bulgari––may additionally flow at a slightly unique pace due to the fact they function greater independently than their peers at other luxury conglomerates.

Swatch Group––which owns the likes of Omega, Breguet, Harry Winston, Blancpain, Glashutte Original and Jacquet Droz––has but to make any most important statement, however its pass can be the most telling. Though it owns several excellent watch manufacturers in its personal right, the business enterprise also acts as a main element dealer to different watch manufacturers.

“Buffett said, “I just hope I see a lot of recessions.” Some of Berkshire Hathaway’s best investments have come during periods of economic turmoil.”

Is there a light at the end of the tunnel? Is it worth it to purchase a watch now? Well, if you believe in the value of priceless luxury items, or even Gold, then yes. All you are doing is investing in your own future.

As stated from a marketrealist.com, “In an interview with CNBC, Warren Buffett, Berkshire Hathaway’s (BRK-B) chairman, was asked if he sees a recession coming—especially since the yield curve briefly inverted last week. Buffett said, “I just hope I see a lot of recessions.” Some of Berkshire Hathaway’s best investments have come during periods of economic turmoil.”

We always hear about the word vintage. In fact, it is plastered all over this website. But what does it exactly mean?

Are we even using the word correctly? Let’s read further and take a look at the history behind the word “vintage.”

History of the word “Vintage.”

The word ‘Vintage’ was first utilized and brought to life in the mid fifteenth century. Taken from an old French vendage, “vintage” meant “wine harvest.”

So what exactly does ‘Vintage’ refer to that is not related to the wine category?

In our context, meaning what we are concentrating on here on our website, the word vintage is used primarily for the luxury watches, cars and other collectibles we are showcasing.

Vintage is an older item, that has deep history to it. In many cases, the item will in fact increase in value if maintained properly. We usually mean an old item, which carries certain nostalgic value, and potentially is of high quality. It would be classified as antique and not be less than two decades old.

When it is applied to collectibles, if it is more than 100 years old, it would be considered antique. Again, if it is between two decades to 100 years old, then we would classify it as vintage. Many of the watches that are showcased on this site are not only vintage, but they are restored and repaired in such was that makes them more valuable then the time they were purchased – subsequently giving the buyer an opportunity to pass it down as an heirloom.

Do not mistaken vintage with retro

There is quite a significant difference between vintage and retro. Retro would be labeled as something that is taken after a vintage item. In other words, it is copied to look like vintage. It does not have the history, nor does it have the opportunity to be passed down with class, as a vintage watch would have.

Many of the great watches we have here are not only vintage, but they are restored in a way that makes them timeless, sophisticated and in even some cases – rare.

Here are just several of the a list of some of the watches below that are available for purchase: