Today I will not write about watch restoration and the ways in which this affects – mainly in the wrong way – both the value and the market of a vintage watch. I would like, instead, to debate the assessment process through which we could – or should, in my opinion – be able to rate such value on a percentage basis or a zero to ten scale. This is obviously my own personal method that is surely susceptible of improvement, but that is the base of all my decisions regarding the buying or selling of a vintage watch.

You have certainly heard (regarding watch restoration), an array of analogies between the collectible watch market and that of vintage automobiles or old paintings, to mention the most common ones. There are, however, many other similar cases: from postage stamps to writing instruments, from antique silver to coins. These are arguably categories that present some similarities to that of vintage watches, but are nonetheless quite different: in fact, all these different objects can be just as desirable yet for a different reason or, better said, a different combination of reasons. And, moreover, each of these categories reflect values determined by prerogatives that are unique to that very category: for a painting, its appearance is for sure more important than its state of preservation, for a post stamp it’s true the exact opposite; for an automobile functionality is key factor, but for a silver samovar or a lantern a detail of little importance.

Just as for any other category of rare and collectible objects, the evaluation criteria of a vintage timepiece include several elements, many of which in common with those of other categories but still unique to that of vintage watches only: conversely, some parameters – albeit also applicable to different objects – cannot be used to assess a vintage watch without doing some damage just like it is actually happening… at least in my opinion.

The elements that for me determine the value – both financial and “cultural-emotional” – of a vintage watch can be divided in two main categories: those of aesthetical nature and of technical-historical nature. My rating will be as much higher as the values within each of these categories are equally balanced, like the two plates of a scale bearing the exact same weight.

The more aligned all the evaluation parameters, the more visible will be what I like to define as the “magic” of a given watch.

Within the realm of the aesthetic perspective are, above all, the overall beauty and the visual impact of the watch: these are two elements that can actually prescind even from its preservation state or the absolute originality of its every component; the patina or the whole visual effect given by the presence – or lack of – signs of aging; the preservation state, from the example untouched but totally destroyed, to the one that has been restored to perfection, from the one absolutely untouched and still like new to others showing every shade in between; the combination model-color, like for example a watch that has a particularly rare dial color and/or hands style or in a particularly unusual metal for that model, like a steel and gold Patek Philippe chronograph.

TECHNICAL DETAILS FOR COLLECTORS

THE MAGIC IS MADE OUT OF TINY ELEMENTS

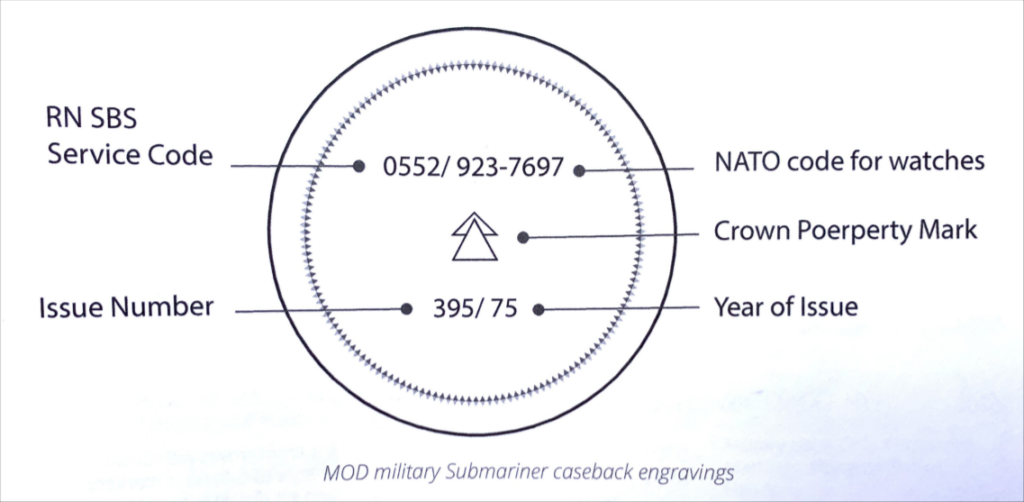

On the other hand, belong to the technical-historical sphere all the elements that relate to the exact prerogatives of a given watch the day it left its original manufacturer. First of all, the originality of each component, that have to necessarily be – at least as far as there is any even minuscule visible difference – factory original; the consistency of each component, meaning that if not “born” with that very watch they must be at least the exact same items included in the original manufacturer’s design and plans; the period correct element, meaning that all components are not only factory original but also correct for the watch’s production timeframe; the rarity of the timepiece as it relates to production numbers; its desirability and availability from a demand/offer perspective; the presence of any original paperwork and accessories.

DOES THE “PERFECT WATCH” EXIST ?

EVERYTHING IS PERSONAL

Theoretically, on a percentage scale a watch in absolutely “like new” conditions should always be the benchmark for a 100% rating, but that is not necessarily always the case. In fact, it is well possible that a watch that shows some aging or some wear may still score the highest possible rating when some of the elements other than condition make up for the flaws. By the same token, it is possible that a well restored example may be more valuable than another that was never “touched” but aged badly, or that a specimen with very visible marks of aging – a perfect example would be that of the “tropical” dials – may be more desirable than the same exact model in absolutely perfect conditions. The “perfect” watch is not always, necessarily, perfect.

DOES IT MAKE ANY SENSE TO STANDARDIZE?

WATCHES AREN’T LIKE POSTAGE STAMPS

The generalized need to unify all the evaluation criteria in a one-size-fits-all code easily applicable by collectors and professionals alike worldwide has reduced this complex process to something similar – to use an example that I find particularly fitting – to that of antique postage stamps: if these are absolutely unused, perfectly “centered”, with a mint gum as originally sold by the post office their value is 100/100. But the moment only one of these parameters is off, their value falls dramatically to a fraction of the full value. When this same method is applied to vintage watches – that very rarely arrive to us as truly unworn – the consequence is that these “ideal” conditions are often the result of invisible restorations or small improvements, such as the replacement of the damage components with same original parts but in better conditions: agreeably accepted by dealers but not shared with their buyers, this seems to be the only way to keep sustainable a market otherwise too resourceless to satisfy the often unrealistic expectations of the demand.

THE ONLINE FLATTENED THE VALUE OF EXPERIENCE

WEB SEARCHING ISN’T LIKE TOUCHING AND WATCHING A PIÉCE

This situation has also contributed to the growth of the category – non-existent until just a few years ago – of vintage watch experts and consultants, a new profession that allows to profit from this market without paying the dues, finding or investing significant funds, exposing oneself to costly errors, scams, thefts or robberies. The experience matured by the “OGs” during the first decades of this market is today available online for free: all one needs is the time to study the material available (or at least enough of it to know a bit more than the next guy does) combined with some self-promotion skills, to be an “expert” who can charge for his services more than he could make buying and selling the same watch for which the consulting is offered. And, more often than not, without having ever owned one, or even a similar one himself!

Obviously, I do not have a high opinion of the category, but I do acknowledge that whereas it includes a decent number of totally incompetent opportunists it also counts a few extremely educated individuals who, in my opinion, could help with their same work the future of this market rather than its demise.

This is something that I promise to get into detail sometimes in the near future.

These newcomers are for the most part more or less informed archivists who excel in comparing all the data available online and/or the equivalent of laboratory technicians, perfectly able to spot an unknown or undisclosed restoration but apparently unprepared to understand its value or to contextualize it into a true, complete evaluation of the example at hand; to attribute monetary values relying on statistical data based on auction results, but unable to suggest any other value than previously attributed to a similar watch by a market precedent; and, especially and unfortunately, perfectly able to leverage on their clients’ fear of losing and desire for gain – both in terms of money and pride – to consolidate a method that grants their industry growing prosperity at the expense of the emotional, esoteric, stylistic and exquisitely aesthetical elements that have determined the very birth of this passion and market as we have learned to love it since its beginnings in the early 1980s.

THE DETRIMENT OF THE EMOTIONAL PART

TO APPRECIATE A VINTAGE OBJECT WE MUST FREE SPACE TO PERSONAL TASTE

Deprived of its emotional content, that in so many ways makes a vintage watch similar to that of a work of art, its prerogative to become part of its owner’s personality defining an object with cultural attributes absolutely unique – so similar, at least for most men to that of some automobiles or motorcycles – the incredibly rich world of vintage watches is on the brinks of following the fate of that of postage stamps and collectible coins. Alessandro Ciani / L.A. (Usa) / Feb.2022.

When Francesca and Fabiana asked me to write something for this issue, they also mentioned that the magazine’s cover would feature Phillips in association with Bacs and Russo. So, the first thing I could think of was to share a couple of thoughts regarding auction houses and how their role in the world of vintage watches affects this market. It is actually a question I have been asked when invited to speak at the Hodinkee10 panel in NY last fall: and, sure enough, it turned out I could think something different from, “Very important contribution!

When Francesca and Fabiana asked me to write something for this issue, they also mentioned that the magazine’s cover would feature Phillips in association with Bacs and Russo. So, the first thing I could think of was to share a couple of thoughts regarding auction houses and how their role in the world of vintage watches affects this market. It is actually a question I have been asked when invited to speak at the Hodinkee10 panel in NY last fall: and, sure enough, it turned out I could think something different from, “Very important contribution!

First of all, some may be best to sell, others to buy; then, location: some perform better in Geneva, others are only good in their home country, others yet can sell in places where the competition can hardly sell at all. So far as selling, by the way, keep in mind that an auction house is only as good as the person who is managing the department at a specific time, just like your bank branch is all about that one employee or manager who really takes your business at heart. And that, no matter how many centuries they have been around. I don’t think this is the place where I should share the personal experiences have had in the past with some of the major auction houses out there but, since this is this issue’s cover, there are a few things I can tell you about Phillips in association with Bacs and Russo.

First of all, some may be best to sell, others to buy; then, location: some perform better in Geneva, others are only good in their home country, others yet can sell in places where the competition can hardly sell at all. So far as selling, by the way, keep in mind that an auction house is only as good as the person who is managing the department at a specific time, just like your bank branch is all about that one employee or manager who really takes your business at heart. And that, no matter how many centuries they have been around. I don’t think this is the place where I should share the personal experiences have had in the past with some of the major auction houses out there but, since this is this issue’s cover, there are a few things I can tell you about Phillips in association with Bacs and Russo. They prefer not selling at all, as opposed to score a bad sale. Which, to some statistical extent, is nevertheless unavoidable every now and then. Conversely, items that some of their competitors may be fearful to include in a sale maybe because of a plain rumor or a technical detail they can’t simply understand and/or explain, they will consider and decide on based on their own internal investigation and due diligence, eventually accepting it: be assured that if the watch is accepted for a sale it’s because it checked all their boxes and no stone has been left unturned. So, Phillips in association with Bacs and Russo. As I said, dealing with auction houses in general involves certain challenges for both buyers and sellers, and this one certainly makes no exception. On the other hand, these guys make THE exception when it comes to innovative approach to the business, awareness of the existing market moment, rigid but outside influence-free lot selection parameters.

They prefer not selling at all, as opposed to score a bad sale. Which, to some statistical extent, is nevertheless unavoidable every now and then. Conversely, items that some of their competitors may be fearful to include in a sale maybe because of a plain rumor or a technical detail they can’t simply understand and/or explain, they will consider and decide on based on their own internal investigation and due diligence, eventually accepting it: be assured that if the watch is accepted for a sale it’s because it checked all their boxes and no stone has been left unturned. So, Phillips in association with Bacs and Russo. As I said, dealing with auction houses in general involves certain challenges for both buyers and sellers, and this one certainly makes no exception. On the other hand, these guys make THE exception when it comes to innovative approach to the business, awareness of the existing market moment, rigid but outside influence-free lot selection parameters. Whether you’re living through a multiple decade tradition… or even starting one yourself, this type of heirloom is symbolic of the legacy a family tree creates. If you’re starting the tradition in your own household, pick a watch that’s representative of your style and preference as well as your interests. The watch should be symbolic of who you are, even more importantly what your family name represents.

Whether you’re living through a multiple decade tradition… or even starting one yourself, this type of heirloom is symbolic of the legacy a family tree creates. If you’re starting the tradition in your own household, pick a watch that’s representative of your style and preference as well as your interests. The watch should be symbolic of who you are, even more importantly what your family name represents.